Background and History

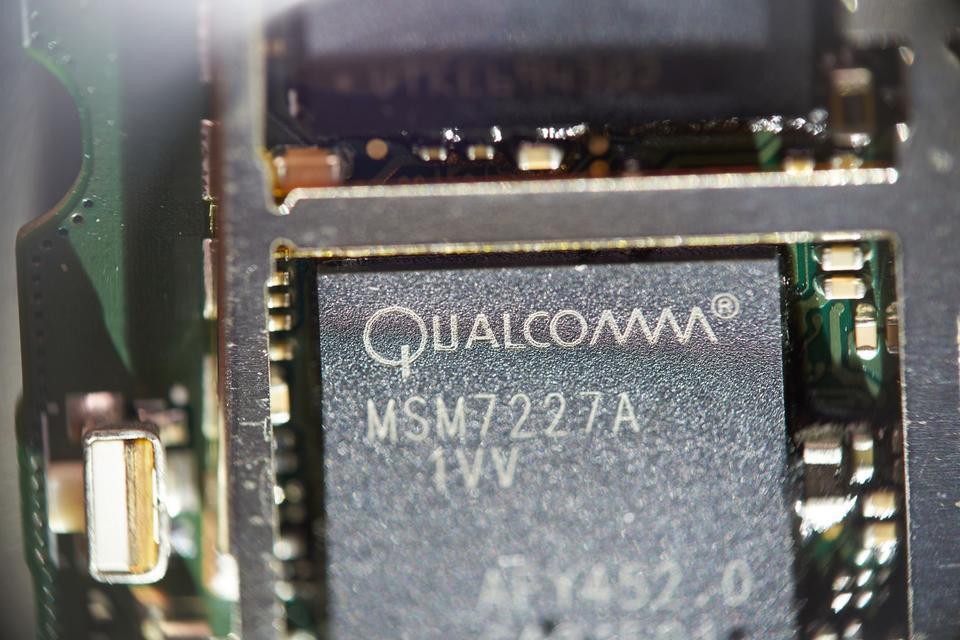

Qualcomm (QCOM) is a significant technology conglomerate with various business units centered around technology. The company mainly operates out of its semiconductor hardware, software, and enterprise services businesses. These provide steady revenues for the company. Recently the pick-up in the semiconductor industry has given way to a substantial price return for Qualcomm shareholders in 2022. I believe this can be replicated in 2022 due to multiple factors. Macro fundamentals are picking up, and with the continued patching up of the supply chain, Qualcomm will see more consistent revenues moving forward. This will also give way to solid margin growth and shrinking OpEx costs due to less volatility in operations. Micro fundamentals will continue to improve due to substantial cash on hand and earnings momentum. Profitability has to give way to a valuation bottom, and investors should soon see a rise to this floor price.

The company's keys to success are apparent, making the stock an excellent buy for retail and institutions alike. The steady earnings and the improving diversification trend will expose Qualcomm to various technologies industries. One of the most exciting developments for Qualcomm is the development of 5G technologies. Qualcomm's existing relationships within the communications industry should continue to improve due to Qualcomm being the primary communications equipment manufacturer for these companies.

Growth and Earnings Strength

There have been powerful earnings momentum for Qualcomm over the past year. This has spurred strong share price growth as well. This will continue as long as Qualcomm can keep its long streak of beating earnings. I am convinced that Qualcomm can be a significant performer in 2022. The company offers a solid macro inflationary hedge and a strong growth story. Due to the stimulus in 2022 and the barrage of incentives, the company will benefit from the continuous 5G rollout.

There has been natural growth stemming from a variety of different business units. In the future, as the automotive and IoT segment grows, there will be increased revenue strength and margin expansion. This is due to the natural incentives the company will experience from municipalities and governments to build out 5G radio towers, equipment support services, etc.

5G will be a significant growth driver for Qualcomm in future quarters. Not just from communications equipment spend but from the perspective of growing the overall base of technology and powering the platforms that will use 5g technology. Various high-tech companies require the 55G buildout to move down the line successfully. Qualcomm's success is coincidentally tied to the success of many exciting startups, which gives Qualcomm the necessary exposure to emerging technologies that other large tech conglomerates don't have.

Operations are Discounted to Future Growth

The company's operations have been expanding across multiple segments due to the diverse earnings growth the company has had over the past two months. The concentration of these businesses has led to fundamental improvement within the industry. This growth should increase in the coming quarters as operations are flourishing, and currently, Qualcomm is out-competing the competition in multiple areas.

The continued operational discipline should be reflected in future earnings. The company has shown growth in bringing down costs and EBIT margin. This impressive growth in the margin shows the new potential scales Qualcomm will be able to play on compared to the sector. This is because of the continued growth of the company's software segment. Inherently SaaS multiples are higher because of the high margins of their products. Qualcomm may see this phenomenon as they continue to build out their software product offerings. As the company advances in its 5G segment, traditional communications providers will look to Qualcomm for guidance. There are very few companies that need to fight for Qualcomm's services. These are Verizon (VZ), AT&T (T), and T-Mobile (TMUS). These conglomerates all operate as the forerunning communications companies in the US. Business from these companies will help measure how fast the US will roll out 5G compared to other countries. While communications may make up a large percentage of the revenue, there are exciting new opportunities from emerging business segments.

Snapdragon digital chassis is a great way to expand its software offerings. Snapdragon Digital Chassis will provide interconnectivity for autonomous and electric vehicle purposes. A new wave of car infrastructure is coming, and Qualcomm is prepared to benefit from electric and autonomous vehicle proliferation.

Risks are Low Due Compared to the Market and Sector

The risks for Qualcomm are slim relative to other tech giants. Many other large tech giants haven't found their niche and spend time pouring money into their legacy businesses which will slowly become obsolete. Qualcomm has found the perfect balance between maintaining its existing communication infrastructure while expanding into new tech. I like the future of Qualcomm due to the strong business fundamentals and technology the company is providing. One concern investors may have the macro outlook. However, I view the new rat announcements by the fed as a positive for QUALCOMM. with the further shrinking of the Fed balance sheet; many disruptors will be forced to either add on more debt or stop expanding. This will benefit Qualcomm as the company will achieve natural growth through the continued expansion of these industries.

Valuation will Improve Analyst Attention

There is room for the valuation to improve. When valuing Qualcomm, a couple of peers stick out as immediate competitors. Firstly Intel (INTC) is a natural choice as they have been competing in the semiconductor space long before AMD (AMD) was a serious competitor. Now that those companies are here, Intel has made fewer changes than Qualcomm and has arguably been left in the past. The next competitor I chose is Texas Instruments (TXN) due to their strong semiconductor and services business. They match what Qualcomm has been trying to achieve and will remain dominant in the semiconductor market for years to come.

Qualcomm had a poor price return for most of 2021. The analysts realized the actual value of the company's expansion into other industries, and the valuations have been expanding since. Now that there has been a pullback, I believe this is a gift for investors who want skin in the innovation game. Qualcomm is a solid pick with a good dividend and exciting growth opportunities.

Qualcomm matched the lowest Price/ Cash flow growth over the past 12 months. This was due to multiple factors due to sharing price appreciation in late 2021will be the model for future growth moving forward. I believe Qualcomm got stuck in a rut before entering a share price super cycle. I like the prospects for Qualcomm in 2021 and beyond.

Conclusion and Rating

Qualcomm looks like a good stock for both growth and value investors. The robust 1.6% dividend and the product portfolio's growth potential make Qualcomm a strong pick. I rate Qualcomm a buy and look forward to evaluating future presentations by the company. If there continues to be a market dip, I will add to my shares of Qualcomm and hold on for the long term.