Banking Regulation and Supervision Agency (Agency) published the Regulation on the Operational Principles of Digital Banks and Service Model Banking (Regulation). Regulation, which was published as a draft on 19 August and gained attention in Fintech and digital banking areas, entered into force on 1 January 2022.

The purpose of the Regulation is stated as “determining the procedures and principles regarding the activities of branchless banks that serve only through electronic banking services distribution channels and providing of banking services as a service model to financial technology companies and other businesses” and focuses on two main subjects: Digital banking and banking as a service.

Digital Banking

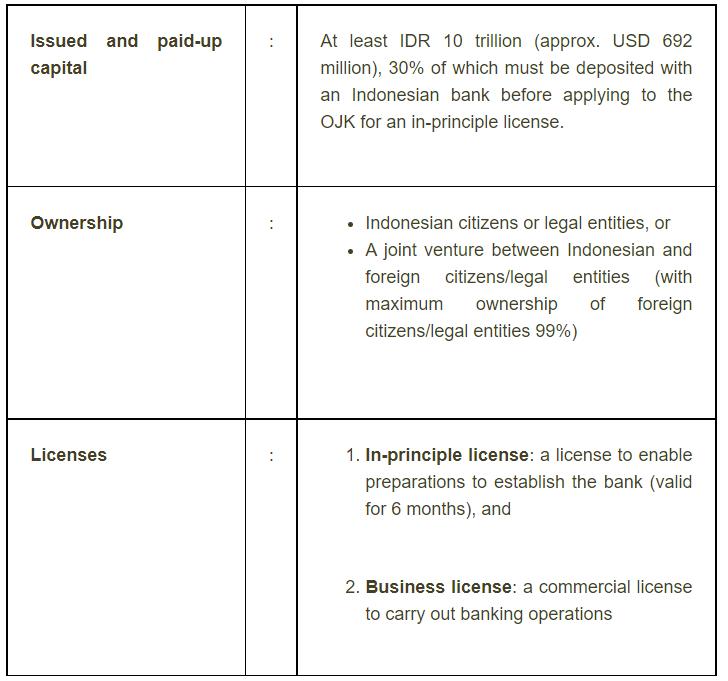

Significant regulations regarding digital banks, which are defined in Regulation as "credit institutions that provide banking services through electronic banking services distribution channels instead of physical branches", are stated below: - Conditions Required for the Establishment and Operating License of Digital Banks: The establishment of digital banks is subject to the fulfillment of the following additional conditions in addition to the classical banking establishment conditions:

- General Principles: As a rule, digital banks can carry out all the activities that credit institutions can perform, depending on whether they are deposit or participation banks. Therefore, in addition to complying with all legislation that credit institutions are obliged to comply with, they must also comply with the provisions of this Regulation.

- Customer Restriction: It is regulated that credit customers of digital banks can only consist of financial consumers and SMSEs. Exceptions to this rule are (i) performing loan transactions between banks or in monetary and capital markets, (ii) extending loans to other banks, and (iii) providing foreign currency loans for businesses that exceed the size of SMSEs.

- Organizational Restriction: Digital banks are not allowed to organize and open physical branches other than the head office and related service units. On the other hand, it is obligatory to establish at least one physical office to deal with customer complaints. While it is allowed to establish ATM networks, safe deposit boxes and escrow transactions can only be offered digitally.

- Credit Restriction: It is regulated that the total amount of unsecured cash consumer loans to be offered by digital banks cannot exceed 4 times the average monthly net income of the customer, and if this cannot be determined, it cannot exceed 10,000 Turkish liras.

- Abolition of Restrictions: In case the paid-in capital amount of digital banks is or is increased to 2.5 billion Turkish Liras, it is possible to abolish the activity restrictions above for the bank with the approval of the Board.

- Service Continuity: The continuity percentage to be committed for electronic banking services of digital banks shall be at least 99.8% and it is required to announce the promised continuity percentage value.

Banking As a Service

In Regulation, interface providers are defined as “Enterprises established as stock corporations that enable their customers to perform banking transactions by accessing the banking services offered by the service bank through the bank's open banking services via a mobile application or an internet browser-based interface”, and banking as a service is defined as “A service model in which customers can perform banking transactions through the service bank by directly connecting to the systems of service banks through open banking services, via the interface offered by the interface providers.” Significant regulations regarding banking as a service are as follows:

- Restrictions on Interface Providers: Banking as a service can only be provided to the interface providers that are established in Turkey. Also, banks are prohibited from being interface providers.

- Restrictions on Advertisement and Promotion: Interface providers are prohibited from misleadingly using expressions that may be interpreted as them being payment service providers such as banks, payment institutions, electronic money institutions or as operating in such manner in their trade names, all kinds of documents, advertisements and declarations or public statements.

- Relations Between the Parties: Service bank can only provide services to the interface provider's customer if an agreement has been concluded between the customer and service bank. Interface provider's mediation in the establishment of this contractual relationship or the provision of banking services over the interface designates the interface provider a support service institution and necessitates the procurement of a permission from the Board.

- Mandatory Elements in Agreements: The elements that must be present in the agreement between the interface provider and the service bank have been specified. We include some of the mandatory elements below:

- Operating License: Since the operating license of banks already covers the services they will provide to interface providers, there is no need to request an additional expansion on operating.

- Responsibilities of the Service Bank: The service bank is required to announce the scope of services on its website, which includes the list of all interface providers it serves and which banking services it provides. In addition, there is an obligation to send a copy of each service contract signed with the interface providers and each contract amendment that envisages a change in the scope of the services, to Agency within one week from the date of signing.

Situation of Current Banks

Banks that obtain an operating license and provide services through physical branches can offer electronic banking services within the scope of their existing license and do not need to make a separate application. On top of this, the provisions of Regulation are not applied to these banks, which means no additional obligations are imposed. However, on-site audit of their information systems is required for these banks to shut down their branches completely and provide only electronic banking services.

Conclusion

Regulation regulates the digital banking system that is currently offered to consumers and paves the way for Fintechs to provide banking services. This has an accelerating and supporting effect on innovations that will emerge in the field of finance.

You can find the full text of Regulation here. (Only available in Turkish)