Since the 1970s, all major advanced economies have shared the experience of declining technological progress. Since this trend has become more pronounced over time, some commentators have already concluded that the world has entered an era of secular stagnation (Gordon 2015, Summers 2014). However, the deceleration has not been completely synchronised across countries. In a recent paper (Christofzik et al. 2021), we examine this development in more detail, focusing on the case of Germany. Specifically, we study prominent explanations using state-of-the-art empirical methods both regarding data construction and empirical identification procedures.

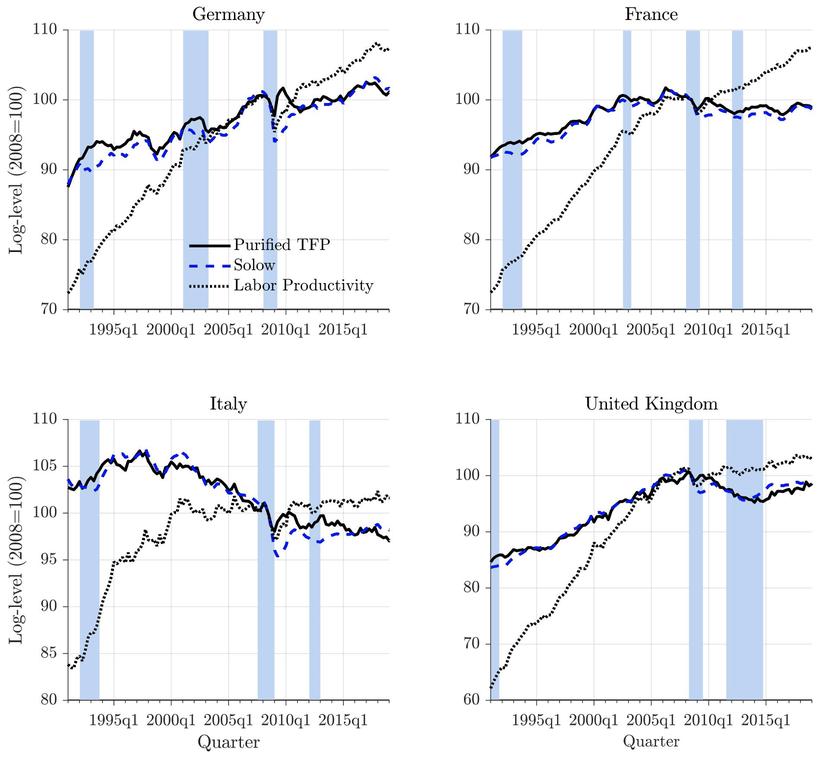

Mapping productivity developments accurately is anything but easy. Figure 1 displays different measures for productivity for Germany, France, Italy, and the UK. Growth of hourly labour productivity as a simple indicator has declined in all countries, this deceleration is especially pronounced in Italy and the UK. It is, however, an incomplete measure for technological progress. As this measure is constructed as the ratio of output and the number of hours worked, it does not exclude variations of other input factors such as physical capital which are not directly linked to technological progress.

Figure 1 Productivity developments in major European countries

Notes: This figure compares our quarterly measure for purified TFP for the major European countries with the Solow residual and labour productivity. It shows the log-levels of the considered variables (annual average of 2008 = 100). Full lines are our quarterly PTFP measures. The blue dashed lines display our quarterly series for the Solow residual. Labour productivity is measured as output per hour worked and shown with dotted lines. Shaded regions reflect recessions as dated by the German Council of Economic Experts (GCEE) for Germany, the Conference Board for France and the United Kingdom, and the Economic Cycle Research Institute (ECRI) for Italy.Source: Christofzik et al. (2021).

An alternative indicator is total factor productivity (TFP) measured by the Solow residual. Displaying this indicator, Figure 1 documents that, abstracting from a few years preceding the financial crisis of 2008-2009, labour productivity growth tends to overstate technological progress. The measurement of technological progress by the Solow residual is nonetheless problematic as it – among other factors – includes cyclical effects. It tends to understate technological progress if factor utilisation decreases, and to overstate it in periods of increasing factor utilisation.

To address this bias, we construct novel quarterly purified TFP (PFTP) series which are adjusted for factor utilisation, inspired by Fernald (2014) and relying on work by Comin et al. (2020). Figure 1 shows that the PTFP is less volatile than the unadjusted Solow residual for all these countries, and that it declined less strongly during the financial crisis in the years 2008/09. This reflects that factor utilisation was adjusted significantly during the crisis.

We stress that, despite all these similarities, Germany is a particularly interesting case, as its economic performance has been quite ambivalent – it even experienced declining unemployment during the euro area crisis and a protracted economic expansion with increasing employment afterwards. Many German industrial companies are viable competitors in world markets, spearheading technological progress in the era of the fourth industrial revolution. And yet, productivity growth has remained modest despite considerable investments into information and communications technology (ICT) capital.

US productivity slowdown: A negligible force

The contemporaneous deceleration of productivity growth in all advanced countries especially since the mid-2000s, raises the question as to whether there are common forces behind that development. The US is commonly considered as the global frontier of technology (Cette et al. 2016) and appears to lead productivity growth in various economic sectors worldwide. Thus, it seems plausible that less technological innovations in the US have caused the decline in productivity growth in other industrial countries.

To study the spillover effects of US technological progress on productivity growth in Germany and other major European countries, we use our novel quarterly PTFP series and estimate structural vector autoregressive (SVAR) models for each of the four European countries for the period from 1991 to 2019. We control for US non-technological factors and technology gains originating from other major countries, applying the medium-run identification procedure proposed by Uhlig (2004).

Figure 2 shows the dynamic reactions of technology following an exogeneous change in US technology for each of the four European countries. We normalise the technology impulse to reflect an increase of PTFP in the US by 1% after 20 quarters. Apart from the UK, we find the productivity spillover effects of US technology shocks to be negligible throughout. In our baseline estimations, the effects are positive but not significantly different from zero for Germany and France. For Italy, the point estimate is negative, but insignificant.

These results suggest that the sluggish US productivity development since the mid-2000s had only small effects on German productivity growth. Therefore, we focus on two potential domestic explanations: structural shifts in the labour market and the impact of digitisation.

Figure 2 The effects of US technology shocks on purified TFP (PTFP) in European countries

Notes: The figure shows the accumulated responses of purified TFP (PTFP) in major European countries after an exogenous increase in US TFP (technology shock). The US technology shock amounts to a 1% increase in US PTFP after 20 quarters. The SVAR models contain US PTFP, the PTFP measure for the country under consideration and ROWPTFP. We estimate our SVAR model with quarterly data beginning with the first quarter of 1991 and ending in the fourth quarter of 2019. All variables are expressed in log-differences and the SVAR model includes four lags and a constant. Blue shaded areas: 68%, 90%, and 95% confidence bands are constructed using a recursive design wild bootstrap, see Gonçalves and Kilian (2004).Source: Christofzik et al. (2021).

Structural shift towards services: A partial explanation

During the last two decades, the German economy evolved quite differently from the US and other large European countries. Particularly remarkable was the strong performance of the German labour market in the years during and after the Great Recession. Starting around 2005, Germany experienced a ‘labour market miracle’ – a protracted transition to a new structural labour market equilibrium, with employment increasing by over 15%, from 39.3 million people in 2005 to 45.3 million in 2019, total hours worked increasing by over 11%, as many of the new jobs were part-time.

Burda and Seele (2020) conclude that the large German labour market reforms implemented from 2003 to 2005 play a major role in explaining the labour market trend since the mid-2000s. These labour market reforms (‘Hartz reforms’) were an important part of a comprehensive reform package dubbed ‘Agenda 2010’ that also comprised reforms in the tax and social security systems (see Burda and Hunt 2011 for details). New jobs were mainly created in the labour-intensive services sectors, where labour productivity is notably lower than in manufacturing.

To construct a counterfactual capturing the development of sector-specific productivity in the hypothetical absence of the German labour market miracle, we keep sectoral compositions constant between 20 individual sectors, similar to de Avillez (2012). The difference between the counterfactual aggregation of the productivity developments within sectors and the actual development then captures the reallocation effect. We separately consider the two periods 1995 to 2005 and 2005 to 2019, thereby excluding the first years after German reunification that witnessed a strong catch-up process in East Germany.

Apparently, the annual decline in the growth rate of productivity per hour worked, from 1.7% during the period 1995 to 2005 to only 0.7% from 2005 to 2019, has largely resulted from developments within individual sectors. Nevertheless, the reallocation between sectors provided a slightly positive contribution of almost 0.2 percentage points to labour productivity growth in the period from 1995 to 2005, as employment shifted to more productive economic sectors, and a negative contribution of more than 0.2 percentage points from 2005 to 2019, due to a structural shift towards relatively unproductive services sectors.

Low productivity effects of ICT: An important piece of the mosaic

Thus, even accounting for these major structural shifts, a substantive part of Germany’s productivity paradox remains to be explained. In Christofzik et al. (2021) we probe the contribution of the massive investments in ICT which underpin the important role of German companies in the fourth industrial revolution. After all, ICT investments kindle aggregate productivity growth via a multitude of channels: directly by raising productivity growth in the ICT-producing sector, and indirectly by fostering complementary innovations (Bloom et al. 2012) and reallocation towards higher-productivity establishments (Foster et al. 2006).

Studies using a growth accounting framework suggest, however, that in Germany, the ICT-producing and ICT-intensive economic sectors contributed relatively little to aggregate labour productivity growth. Moreover, technological progress originating in the ICT sector was rather small in the years after 2012. By contrast, US productivity growth in the second half of the 1990s was heavily concentrated in the ICT-producing manufacturing sector (Jorgenson 2001). Stiroh (2002) shows that these gains were followed by significant productivity surges in ICT-intensive sectors.

To study how technological progress originating from producers of ICT goods and services is transmitted to other sectors, we identify exogenous technological changes originating from ICT (ICT technology shocks) using a novel identification procedure that relies on the relative price of ICT goods and services. Figure 3 depicts the impulse response functions of labour productivity in the non-ICT and the ICT sectors after an ICT technology shock. These results suggest that such a shock leads to a sizeable and permanent increase in labour productivity in the ICT sector, whereas the reaction in the non-ICT sector is insignificant throughout.

Figure 3 Effects of an ICT technology shock

Notes: This figure depicts the accumulated impulse response functions after an ICT technology shock identified by using our two-step procedure. The SVAR model contains labour productivity for the non-ICT sector and the ICT sector, the relative price of produced value added between the ICT sector and the non-ICT sector, hours per worker and total employment. The impulse response functions of employment in the non-ICT and ICT sector are determined by using a subset SVAR in which we impose the restrictions that these variables are not included in the equations of the initial SVAR model. We estimate our SVAR model with quarterly data beginning with the first quarter of 1991 and ending in the fourth quarter of 2017. All variables are expressed in log-differences and the SVAR model includes four lags and a constant. Blue shaded areas: 68%, 90%, and 95% confidence bands are constructed using a recursive design wild bootstrap, see Gonçalves and Kilian (2004).Source: Christofzik et al. (2021).

At first glance, it therefore seems that technological progress in the ICT sector has no effects on the rest of the economy. To explore the mechanism behind these findings, panels (d) to (f) of Figure 3 display the reactions of gross value added and employment of the total economy after an ICT technology shock. Both production and employment rise considerably after an ICT technology shock, with dynamic reactions of almost equal magnitude. As labour productivity is constructed as the ratio of output and employment, the resulting net effect on productivity is almost zero.

Thus, while digitisation is a driving force of economic prosperity also in Germany, its net effect on labour productivity growth is modest. Technological gains in the ICT-producing sector apparently act like investment-specific technological progress: After an investment-specific technology shock labour input also rises by almost the same amount as output. Similarly, the digitisation of the German economy seems to have strong positive effects on both GDP and employment. These results are reflected in several general equilibrium macro models such as Smets and Wouters (2007).

Conclusions

While declining productivity growth is a shared experience among advanced economies, developments in Germany do not merely mirror the slowdown in the US. Instead, two domestic factors partly solve the paradox. First, productivity growth has been curbed as a side effect of the structural shift from the highly productive manufacturing sector towards services. Second, technology gains in ICT translate into higher output and higher employment. This cushions productivity growth as these two positive effects almost cancel each other out. These results show that higher productivity growth should not be the sole policy objective.

References

Bloom, N, R Sadun and J Van Reenen (2012), “Americans do IT better: US multinationals and the productivity miracle”, American Economic Review 102: 167–201.

Burda, M C and J Hunt (2011), “What explains the German labor market miracle in the Great Recession?”, Brookings Papers on Economic Activity 1: 273–335.

Burda, M C and S Seele (2020), “Reevaluating the German labor market miracle”, German Economic Review 21: 139–179.

Cette, G, J Fernald and B Mojon (2016), “The pre-Great Recession slowdown in productivity”, European Economic Review 88: 3–20.

Comin, D A, J Q Gonzalez, T G Schmitz and A Trigari (2020), “Measuring TFP: The role of profits, adjustment costs, and capacity utilization”, NBER Working Paper 28008.

Christofzik, D, L P Feld, S Elstner and C M Schmidt (2021), “Unraveling the Productivity Paradox: Evidence for Germany”, CEPR Discussion Paper16187.

de Avillez, R (2012), “Sectoral contributions to labour productivity growth in Canada: Does the choice of decomposition formula matter?”, International Productivity Monitor 24: 97–117.

Fernald, J G (2014), “A quarterly, utilization-adjusted series on Total Factor Productivity”, Working paper series 2012-19, Federal Reserve Bank of San Francisco.

Fisher, J (2006), “The dynamic effects of neutral and investment-specific technology shocks”, Journal of Political Economy 114: 413–451.

Foster, L, J Haltiwanger and C J Krizan (2006), “Market selection, reallocation, and restructuring in the U.S. retail trade sector in the 1990s”, Review of Economics and Statistics 88: 748–758.

Gonçalves, S and L Kilian (2004), “Bootstrapping autoregressions with conditional heteroskedasticity of unknown form”, Journal of Econometrics 123: 89–120.

Gordon, R J (2015), “Secular stagnation: A supply-side view”, American Economic Review 105: 54–59.

Jorgenson, D W (2001), “Information technology and the U.S. economy”, American Economic Review 91: 1–32.

Smets, F and R Wouters (2007), “Shocks and frictions in US business cycles: A Bayesian DSGE approach”, American Economic Review 97: 586–606.

Stiroh, K J (2002), “Information technology and the U.S. productivity revival: What do the industry data say?”, American Economic Review 92: 1559–1576.

Summers, L H (2014), “Reflections on the ‘New secular stagnation hypothesis’”, in C Teulings and R Baldwin (eds.), Secular stagnation: Facts, causes, and cures,CEPR press.

Uhlig, H (2004), “Do technology shocks lead to a fall in total hours worked?”, Journal of the European Economic Association 2: 361–371.