A California law passed in the late 1980s originally meant to protect consumers is under increased scrutiny for restraining the use of telematics in auto insurance underwriting.

Tesla Inc. CEO Elon Musk joined a chorus of insurance industry participants criticizing Proposition 103, which, among other things, limits insurers' use of data gathered by telematics technology. The law is "contrary to the best interest of the consumers in California and should be changed," Musk said during a Jan. 26 earnings conference call.

Tesla, which has partnered with State National Insurance Co. Inc. to offer auto insurance coverage for the electric vehicles it produces, is "pushing very hard" for California to revise its laws governing the use of telematics, said Musk.

The 1988 law requires that private auto rates primarily be determined based on the insured's driving record, experience and number of miles driven annually. But it effectively precludes carriers from employing more granular usage-based data that they now can obtain through telematics, such as hard braking, speeding and distracted driving.

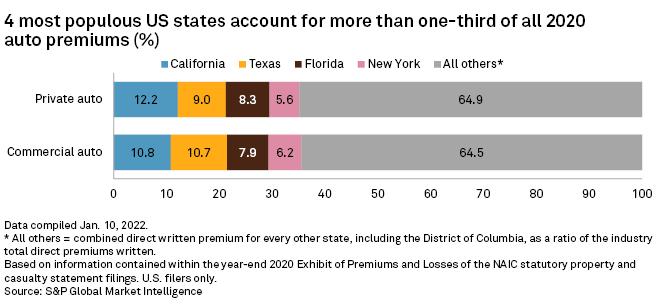

Telematics being limited in California is significant for insurance operations nationwide since it is the largest private auto insurance market in the U.S. by a wide margin. Direct private auto premiums written in the state totaled $30.32 billion in 2020, accounting for 12.2% of the U.S. total.

Alex Timm, CEO of auto-focused insurtech Root, said Proposition 103 is a "large impediment" that negatively impacts consumers.

"We're using lots of our technology and can still use things like mileage," Timm said. "But in general, we think that the law does stifle innovation quite a bit."

The COVID-19 pandemic accelerated the push for usage-based pricing through telematics amid dramatic changes in consumer driving habits and a desire among carriers to more accurately apply rate to risk. Rising claim frequency and severity pushed the U.S. private auto industry's direct incurred loss ratio to 72.1% in the third quarter of 2021, the highest quarterly mark since at least 2016. A year earlier that figure stood at 58.2%.

Musk said telematics can inform insurers about policyholder driving habits and influence those habits as well. That could lead to lower costs for both consumers and carriers.

"If they drive safer, their insurance costs less, so they drive safer," he said. "Tesla Insurance with informatics and real-time feedback encourages safer driving and rewards it monetarily. It's great."

The California Department of Insurance said in a statement that it continues to uphold the current rules, which essentially bar the use of telematics for anything other than miles driven.

A fairer way to underwrite?

The insurance industry is facing increased pressure to move beyond using many of the underwriting factors it has relied on for decades. Legislators, regulators and consumer groups have argued that factors including credit scores, education, occupation and ZIP code put some consumers at an unfair disadvantage when seeking coverage.

Since the summer of 2020, a working group of the National Association of Insurance Commissions has been examining practices across the industry, including underwriting, that may be harmful to minority groups. During an August 2021 meeting, regulators discussed whether they need to be more aggressive in collecting and analyzing data to possibly uncover racial bias in underwriting.

The traditional measures insurers use "really are quite biased, and do perpetuate things like systemic racism and inequality," said Root's Timm. "We've got to get rid of this, and all we've got to do is replace it with something that consumers can actually control."

Telematics may provide a potential solution for insurers feeling regulatory heat, but carriers also face the challenge of ensuring how they process telematics data does not end up introducing new biases, said Douglas Heller, the Consumer Federation of America's insurance expert. Stringent testing of algorithms may help tackle those concerns.

"None of that should be difficult," Heller said. "And none of that should prohibit the implementation of telematics systems that really do help price consumers on how we drive rather than who we are."

Industry trade groups acknowledge that telematics is part of the future of auto underwriting, alongside the traditional rating factors.

Jeffrey Brewer, vice president of public affairs at APCIA, said his organization stands firm on the idea that insurers need to consider the entire picture of a driver when writing auto policies. He dismissed the idea that "driving" and "non-driving" factors could be separated out in the underwriting process.

"We reject that idea because all the factors that are used are related to and can be connected with driving behaviors," Brewer said in an interview. "If you are using a wide variety of factors that are all related to driving behaviors, you get a more complete picture of the risks that a driver may represent."