The following discussion and analysis of our financial condition and results ofoperations together with the condensed consolidated financial statements and therelated notes appearing elsewhere in this Quarterly Report containsforward-looking statements that involve risks and uncertainties. Our actualresults and the timing of events may differ materially from those expressed orimplied in such forward- looking statements as a result of various factors,including those set forth in "Cautionary Note Regarding Forward-LookingStatements" included herein and "Risk Factors" included in this Quarterly Reportand our Annual Report on Form 10-K for the year ended December 31, 2021, filedwith the SEC on April 1, 2022 (our "Annual Report").Overview

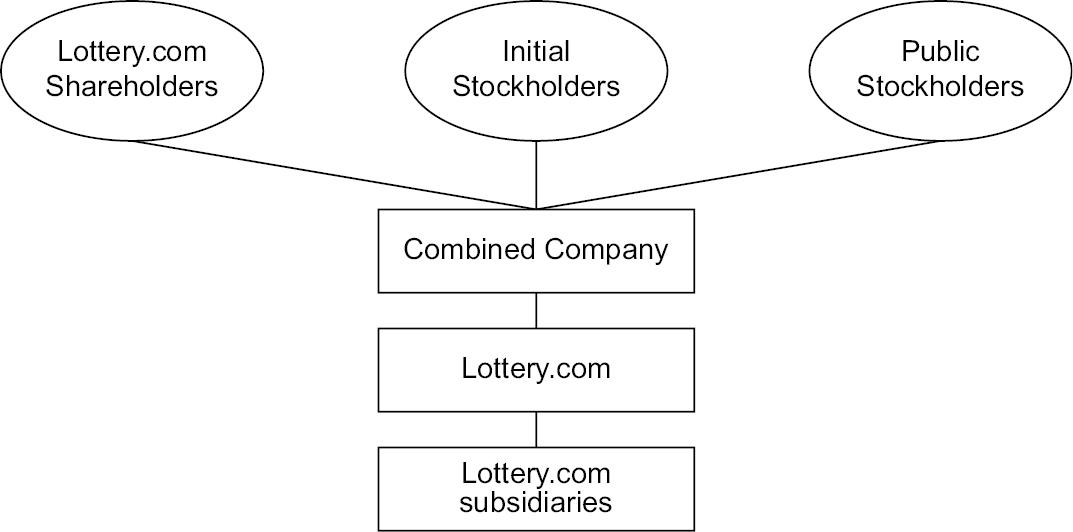

Lottery.com (formerly known as Trident Acquisitions Corp., or "TDAC") is aleading provider of domestic and international lottery products and services. Asan independent third-party lottery game service, we offer a platform that wearchitected, developed, and operate to enable the remote purchase of legallysanctioned lottery games in the U.S. and abroad (the "Platform"). Our revenuegenerating activities consist of (i) offering the Platform via our Lottery.comapp and our websites to users located in the U.S. and internationaljurisdictions where the sale of lottery games is legal and our services areenabled for the remote purchase of sanctioned lottery games (our "B2CPlatform"); (ii) selling credits ("LotteryLink Credits") that can be exchangedfor flexible promotion packages that include our marketing collateral, prepaidadvertising, development services, account management, and prepaid lottery gamesfor use in promotions to our third-party master affiliate marketing partners(our "Master Affiliates") for use by them and by their sub-affiliates (togetherwith the Master Affiliates, the "Affiliates") in undertaking affiliate marketingactivities and promoting our B2C Platform ("LotteryLink"); (iii) offering aninternally developed, created, and operated business-to-business applicationprogramming interface ("API") of the Platform to enable our commercial partners,in permitted U.S. and international jurisdictions, to purchase certain legallyoperated lottery games from us and to resell them to users located within theirrespective jurisdictions ("B2B API"); and (iv) delivering global lottery data,such as winning numbers and results, and subscriptions to data sets of ourproprietary, anonymized transaction data pursuant to multi-year contracts tocommercial digital subscribers ("Data Service").We currently derive substantially all of our revenue from the sale ofLotteryLink Credits, service fees paid to us by users of our B2C Platform,revenue share arrangements with commercial partners participating in our B2BAPI, and subscription fees from users of our Data Service. We intend to pursuegrowth by implementing new products and features within our B2C Platformservices, growing our LotteryLink program, expanding our B2C offering into newdomestic and international jurisdictions, entering into additional agreementswith new commercial partners for our B2B API, growing our LotteryLink Creditprogram, executing on strategic acquisitions and other synergisticopportunities, including gaining access to complementary and new technologythrough such acquisitions, and investing in and developing new technology andenhancing our existing technology in each of our business lines, includingdistributed ledger technology. In December 2021, we finalized the acquisition ofthe domain name https://sports.com and are exploring opportunities for theintended strategic entry into legal sports gaming verticals, which may includethe distribution of sports lottery games.In addition, we also expect to grow our brand and commitment to social awarenessthrough our affiliation with WinTogether. WinTogether is a registered 501(c)(3)charitable trust that supports charitable, educational and scientific causes.Messrs. DiMatteo and Clemenson formed WinTogether and continue to act astrustees. We operate the WinTogether Platform on behalf of WinTogether, as wellas the sweepstakes offered through https://wintogether.org (the "WinTogetherPlatform"), which support charitable causes selected by the trustees ofWinTogether. These sweepstakes work to incentivize participants to donate tothose chosen causes. Donors to each campaign are automatically entered into thesweepstakes for the chance to win cash prizes, luxury items, and exceptionalexperiences. In exchange for operating the WinTogether Platform and thesweepstakes on behalf of WinTogether, we receive a fee from the gross donationsfrom each sweepstakes. While the revenue received from the Company's servicesrelating to the WinTogether Platform are currently nominal, we believe that ouroperation of the WinTogether website and sweepstakes could be a scalable sourceof revenue in the future as well as a mechanism to increase our brand reputationand recognition by sweepstake participants, which could result in theacquisition and monetization of new users to our B2C Platform. 2Business CombinationOn October 29, 2021, we consummated a business combination (the "BusinessCombination") with AutoLotto, Inc. ("AutoLotto"). Following the closing of theBusiness Combination (the "Closing") we changed our name from "TridentAcquisitions Corp." to "Lottery.com Inc." and the business of AutoLotto becameour business. The Business Combination was pursuant to the terms of that certainBusiness Combination Agreement, dated as of February 21, 2021 (the "BusinessCombination Agreement"), by and among TDAC, Trident Merger Sub II Corp., awholly-owned subsidiary of TDAC ("Merger Sub") and AutoLotto. Pursuant to theterms of the Business Combination Agreement, Merger Sub merged with and intoAutoLotto with AutoLotto surviving the merger as a wholly owned subsidiary ofTDAC, which was renamed "Lottery.com Inc." The aggregate value of theconsideration paid by TDAC to the holders of AutoLotto common stock in theBusiness Combination (excluding shares that may be issued to former AutoLottostockholders (the "Sellers") as earnout consideration) was approximately $440million, consisting of approximately 40,000,000 shares of Common Stock valued at$11.00 per share. In addition, the Sellers and TDAC's founders are also entitledto receive up to 3 million and 2 million additional shares of Common Stock,respectively, to the extent that certain share price targets are achievedfollowing the Closing.Recent DevelopmentsCOVID-19 UpdateIn a typical year, the sales volume of draw games depends heavily on thedevelopment of a few notably large jackpots. Suppression of sales (owing, forinstance, to restricted visits by players to locations where tickets are sold asa result social distancing or other measures put in place as a result ofCOVID-19, even if the drawings are themselves continued as scheduled) worksagainst the continued development of these notable jackpots. By contrast, thebetting opportunities offered through instant win games, such as scratchers, aretypically unaffected by the volume of play, and therefore, tickets for instantwin games are considered more like merchandise (similar to canned goods) thatmay be "bought ahead," even during the curtailment of retail, orperson-to-person, visits. According to the World Lottery Association, during2020, sales of instant win games remained within 1% of the 2019 levels for suchsales, despite pandemic-related restrictions that resulted in the temporaryclosure of retail locations that are the primary point of sale for instantwingames.

Throughout the COVID-19 pandemic, sales of online lottery games, which are paidentirely from mobile devices or computers ("Online Lottery") via digitalchannels, experienced more ticket sales growth than the alternative,person-to-person sales. The proportion of all sales occurring through digitalchannels reached 17% across World Lottery Association membership in 2021, anincrease of 11% over the same figure in 2020.The shift in consumer purchasing activity toward online purchasing has catalyzeddemand for the mobile and online delivery of lottery games. As an early entrantin the delivery of digitized representation of lottery games with an establishedand growing user base in the U.S. and abroad, we believe that we remainwell-positioned to capitalize on what we expect to be a continued shift towardsa new demography of customers who rely on mobile and online means foracquisition of consumer goods, including lottery games and other forms of onlinegaming. For example, we experienced a 123% year-over-year increase in ourworldwide sale of unique lottery games between 2020 and 2021, which we primarilyattribute to the shift in consumer purchasing habits to mobile and onlinepurchases due to COVID-19.We believe in attracting the best talent wherever it is located and that adistributed remote workforce is the best objective of the Company'sorganizational needs. We also reassess our business continuity programs on anongoing basis and in light of new developments relating to the COVID 19 pandemicto ensure that our employees remain protected, and that demand for our productsand services remains consistent. 3Launch of Project NexusWe are developing a proprietary, blockchain-enabled gaming platform, which wehave named Project Nexus. The Project Nexus platform is designed to handle highvolumes of user traffic with the goal of improving users' experience throughenhancing the security speed of our platforms and making them more reliable. Theinitial phase of Project Nexus was implemented in the second quarter of 2022.See below for more information.Key Elements of our Business

Mobile Lottery Game Platform Services

Both our B2C Platform and our B2B API provide users with the ability to purchaselegally sanctioned draw lottery games via a mobile device or computer, securelymaintain their acquired lottery game, automatically redeem a winning lotterygame, as applicable, and receive support, if required, for the claims andredemption process. Our registration and user interfaces are designed to be easyto use, provide for the creation of an account and purchase of a lottery gamewith minimum friction and without the creation of a mobile wallet or requirementto pre-load minimum funds and - importantly - to provide instant confirmation ofthe user's lottery game numbers, whether selected at random or picked by theuser. In consideration of our B2C Platform services, users pay a service feeand, in certain non-U.S. jurisdictions, a mark-up on the purchase price. Wegenerate revenue from that service fee and mark-up.LotteryLink CreditsIn the third quarter of 2021, we launched LotteryLink, our affiliate marketingprogram. As part of LotteryLink, we pay each of our Affiliates a percentage ofthe revenues derived from each new customer they refer to us and, if suchcustomer is located in a jurisdiction in which they may lawfully use our B2CPlatform, is converted to a user. These commissions are paid for a contractuallyspecified duration of such user's activity on the B2C Platform. In support oftheir promotional activities, our Master Affiliates purchase credits, referredto as a LotteryLink Credit, from us that can be redeemed for flexible promotionpackages, consisting of marketing collateral, prepaid advertising, developmentservices, account management, and prepaid promotional rewards that may redeemedby users, upon account activation, to acquire lottery games that can be used inpromotions. We generate revenue from the sale of the LotteryLink Credits and webelieve that we may generate additional revenue through LotteryLink in thefuture by these Affiliates purchasing more LotteryLink Credits.Data Services

Our application and websites offer comprehensive multi-jurisdiction lotteryresult information, without the requirement to create an account. Additionally,our Data Service delivers daily results of domestic and international lotterygames from more than 40 countries to over 400 digital publishers and mediaorganizations, pulled from real time primary source data.

We generate revenue from the subscription fees paid by our subscribers forannual access and also additional per record fees. We also generate fees frommulti-year contracts pursuant to which we sell proprietary, anonymizedtransaction data.

The WinTogether PlatformUnlike lottery games and other games of chance, participation in sweepstakes ispermissible in almost every state within the U.S. and sweepstakes offered on theWinTogether Platform are open to participants within the U.S. and certaininternational jurisdictions, unless prohibited by local law or regulation. Whena participant donates to a campaign cause on the WinTogether Platform, they areautomatically entered to win a prize; provided, however, in accordance with thesweepstakes requirements of most jurisdictions and the terms of service for eachsweepstakes, no purchase or donation is required for entry into sweepstakesoffered on the WinTogether Platform.We are the operator and administrator of all sweepstakes on the WinTogetherPlatform. In consideration of our operation of the WinTogether Platform andadministration of the sweepstakes, we receive a percentage of the grossdonations to a campaign, from which we pay certain dividends and alladministration costs. We expect that participation in the sweepstakes offered onthe WinTogether Platform will continue to grow as we and WinTogether's trusteescontinue to develop its offerings. In addition to the benefit of thephilanthropic opportunities generated by the WinTogether Platform, we view itsoperation as a scalable source of revenue as well as a mechanism to increase theCompany's brand reputation and recognition. 4Synergistic Growth

In addition to organic growth of our current revenue generating activities, weintend to grow our business through synergistic acquisitions, as evidenced byour acquisition of 100% of the equity of Global Gaming Enterprises, Inc., aDelaware corporation ("Global Gaming"), which holds 80% of the equity of each ofMedios Electronicos y de Comunicacion, S.A.P.I de C.V. ("Aganar") andJuegaLotto, S.A. de C.V. ("JuegaLotto") in June 2021, which we believe providesgrowth potential for us in the Mexican and Latin American markets, and ourrecent acquisition of the "Sports.com" domain as part of our plan to entersports betting in December 2021.Performance MeasuresIn managing our business and assessing financial performance, we supplement theinformation provided by our financial statements with other operating metrics.We use these metrics to evaluate our business, measure our performance, identifytrends affecting our business, formulate projections and make strategicdecisions. The primary operating metrics we use are: ? transactions per user; ? tickets per transaction;

? gross revenue per transaction;

? gross profit per transaction; and

? gross margin per transaction.

These metrics help enable us to evaluate pricing, cost and customerprofitability. We believe it is useful to provide investors with the samemetrics that we use internally to make comparisons of our historical operatingresults, identify trends in our operating results and evaluate our business.These metrics track our B2C business and exclude users who were referred by anaffiliate or who made purchases through an API partner. Three Months EndedMarch 31,20222021Transactions Per User (annualized)12.58 9.46Tickets Per Transaction3.68 4.09Gross Revenue Per Transaction$ 8.75$ 10.16Gross Profit Per Transaction $ 1.30$1.48Gross Margin per Transaction 14.9 % 14.6 %Transactions Per User

Transactions per user is the average number of individual transactions per userin a given period. An individual transaction is defined as the placement of anorder by a user on our Platform. We use this measure to determine the overallperformance of our products on a per user basis. When considered with the otheroperating metrics, transactions per user provides insight into user stickinessand buying patterns and is a useful tool to identify our most active users,which enables us to deploy more targeted marketing and other strategicinitiatives. This metric also gives us the ability to categorize users based ontheir performance and determine where to expend marketing and/or operationalresources. Transactions per user may be subject to variables that are outside ofour control, for instance the size and popularity of a particular lottery game. 5Tickets Per TransactionTickets per transaction is the average number of lottery game tickets purchasedby a user per transaction. We use this measure to analyze the impact of productperformance with our customers on the number of tickets sold in one transaction.We believe this metric is useful for our investors because it gives insight intothe buying habits of our users. Similar to transactions per user, tickets pertransaction may be subject to variables that are outside of our control, forinstance the size and popularity of a particular lottery game.

Gross Revenue Per Transaction

Gross revenue per transaction is the average gross amount of revenue pertransaction. We use this measure to determine how our top line revenue isperforming on a per transaction basis, which helps us to identify and evaluatepricing trends. We believe this metric is useful for our investors because itprovides insight into our revenue growth potential on a per transaction basis.Gross Profit Per TransactionGross profit per transaction is our average gross profit per transaction,calculated as gross revenue less the cost of the lottery game ticket and anyprocessing fees, including labor, printing and payment processing, pertransaction. We believe this metric to be useful to evaluate and analyze ourcosts and fee structure across product offerings and user cohorts, andadditionally, helps our investors because it provides insight into our profitgrowth potential on a per transaction basis.Gross Margin Per Transaction

Gross margin per transaction is calculated by dividing gross profit pertransaction by gross revenue per transaction. We consider this metric to be ameasure of overall performance that provides useful information about theprofitability of our B2C Platform.

Components of Our Results of Operations

Our Revenue

Revenue from B2C Platform. Our revenue is the retail value of the acquiredlottery game and the service fee charged to the user, which we impose on eachlottery game purchased from our B2C Platform. The amount of the service fee isbased upon several factors, including the retail value of the lottery gamepurchased by a user, the number of lottery games purchased by a user, andwhether such user is located within the U.S. or internationally. Currently, inthe U.S, the minimum service fee is $0.50 for the purchase of a $1 lottery gameand $1 for the purchase of a $2 lottery game; the service fee for additionallottery games purchased in the same transaction is 6% of the face value of alllottery games purchased. For example, the service fee for the purchase of five$2 tickets is $1.60, being the $1 base service fee, plus 6% of the aggregatevalue of the face value of all lottery games purchased. In the quarter-endedMarch 31, 2022, our domestic B2C Platform users purchased an average of 3.7lottery games per transaction at an average service fee of $0.37 per lotterygame. For the twelve months ended March 31, 2022, we had an average gross profitper domestic B2C Platform user, where the definition of gross profit is the sameas defined under "Gross Profit per Transaction", of approximately $34.60. Duringthe quarter-ended March 31, 2022, the Company's digital marketing spend wasfocused on testing the effectiveness of sample marketing campaigns. We had aretention rate of domestic users of 85% for the twelve months ended March 31,2022, excluding any customers referred by an affiliate or API partner, whichresults in a lifetime user value, on average, of $176.55. 6

Internationally, B2C sales in jurisdictions where we do not have direct orindirect authority generate an immaterial amount of revenue, and we areassessing our operations in these jurisdictions.

Revenue from Sale of LotteryLink Credits. We sell LotteryLink Credits to ourthird-party Affiliates, which may be redeemed for advertising credits, marketingcollateral, development services, account management services and prepaidpromotional rewards. In the three months ended March 31, 2022, we sold $18.0million in LotteryLink Credits for prepaid promotional rewards, marketingmaterials and development services. Revenue from the sale of LotteryLink Creditsin future periods may vary due to regulatory or contractual obligationsapplicable to our affiliates or sub-affiliates, which may impact our, ouraffiliates', or their sub-affiliates' ability to undertake the campaign thatmanagement initially anticipated.Revenue from B2B API. Together with our third-party commercial partner, we agreeon the amount of the mark-up on the cost to be imposed on the sale of eachlottery game purchased through the B2B API, if any, together with a service feeto be charged to the user; we receive up to 50% of the net revenues from suchmark-up and service fee pursuant to our commercial agreement with eachcommercial partner. In the U.S., the Company's average gross revenue per suchlottery game sale was $2.00 in the three months ended March 31, 2022. Wecurrently do not charge our commercial partners a fee for the use of the B2BAPI.

In the third quarter of 2021, we launched LotteryLink, which is intended toleverage third party Affiliates across multiple industries and marketingchannels to acquire users on our behalf. The initial phase of this programinvolved the sale and transfer of LotteryLink Credits to a Master Affiliate foruse in providing affiliate marketing packages to other third party Affiliates.Affiliate marketing packages include the LotteryLink Credits, which, in the nextphase of this program, such third party Affiliates will be able to use topromote and distribute our products on their platforms. We believe that we maygenerate additional revenue through LotteryLink in the future by these thirdparty Affiliates purchasing more LotteryLink Credits.In the three months ended March 31, 2022, we had agreements to acquire and selllottery games through the B2B API with three international third-partycommercial partners, including a French betting solution and one U.S.third-party commercial partner, which operates a proprietary mobile wallet foruse at traditionally coin-operated machines, such as arcade games, vendingmachines, and laundry machines, which enabled our offerings on its mobileapplication. Collectively, these agreements provided us with access to over420,000 unique points of sale for users to acquire lottery games via our B2BAPI. 7

Data Services. Commercial acquirers of our Data Service pay a subscription foraccess to the Data Service and, for acquisition of certain large data sets, anadditional per record fee. The Company additionally enters into multi-yearcontracts pursuant to which it sells proprietary, anonymized transaction datapursuant to multi-year agreements and in accordance with our Terms of Service inconsideration of a fee.

Our Operating Costs and Expenses

Personnel Costs. Personnel costs include salaries, payroll taxes, healthinsurance, worker's compensation and other benefits for management and officepersonnel.

Professional Fees. Professional fees include fees paid for legal and financialadvisors, accountants and other professionals related to the BusinessCombination and other transactions.

General and Administrative. General and administrative expenses includemarketing and advertising, expenses, office and facilities lease payments,travel expenses, bank fees, software dues and subscriptions, expensed researchand development ("R&D") costs and other fees and expenses.

Depreciation and Amortization. Depreciation and amortization expenses includedepreciation and amortization expenses on real property and other assets.

Key Trends and Factors Affecting Our Results

The following describes the trends associated with our business that haveimpacted, and which we expect will continue to impact, our business and resultsof operations in a material way:

COVID-19. For the trends and other impacts related to the COVID-19 pandemic thatmay continue to impact our business and results of operations, please see"Recent Developments-Impacts of COVID-19," above.

International operations. We face challenges related to expanding our footprintglobally and the related process of obtaining the licenses and regulatoryapprovals necessary to provide services and products within new and emergingmarkets. Largely as a result of the COVID-19 pandemic, the internationaljurisdictions where we operate and seek to expand have been subject toincreasing foreign currency fluctuations against the U.S. dollar, soaringinflation and political and economic instability. We expect these trends tocontinue during fiscal 2022 and believe they are likely to cause a materialdecrease in consumer spending, which could have a material impact on ourrevenues. We expect that it will take a longer period of time to achieve revenuegains or generate cash in the new regions or any new international jurisdictionsin which we expand, outside of our domestic geographies.Introduction of a new gaming platform. We have developed a proprietary,blockchain-enabled gaming platform, which we have named Project Nexus. ProjectNexus is designed to handle high levels of user traffic and transaction volume,while maintaining expediency, security, and reliability in processing lotterygame sales, the retail requirements of the B2C Platform, the administrative andback-office functionality required by the B2B API, and the claims and redemptionprocess. We expect to utilize this platform to launch new products, includingany proprietary products we may introduce. The introduction of new technologylike Project Nexus is subject to risks including, for example, implementationdelays, issues successfully integrating the technology into our solutions, orthe possibility that the technology does not produce the expected benefits.

8Our growth plans and the competitive landscape. Our direct competitors operatein the global entertainment and gaming industries and, like us, seek to expandtheir product and service offerings with integrated products and solutions. Ourshort-to-medium term focus is on increasing our penetration in our existing U.S.jurisdiction by increasing direct to consumer marketing campaigns, introducingour B2C Platform into new U.S. and international jurisdictions, growing ourLotteryLink program through the addition of new Affiliates, and acquiringsynergistic regulated and sports betting enterprises domestically and abroad.Competition in the sale of online lottery games has significantly increased inrecent years, is currently characterized by intense price-based competition, andis subject to changing technology, shifting needs and frequent introductions ofnew games, development platforms and services. To maintain our competitive edgealongside other established industry players (many of which have more resources,or capital), we expect to incur greater operating expenses in the short-term,such as increased marketing expenses, increased compliance expenses, increasedpersonnel and advisory expenses associated with being a public company,additional operational expenses and salaries for personnel to support expectedgrowth, additional expenses associated with our ability to execute on ourstrategic initiatives including our aim to undertake merger and acquisitionactivities, as well as additional capital expenditures associated with theongoing development and implementation of Project Nexus.Results of Operations

Three Months Ended March 31, 2022 Compared to Three Months Ended March 31, 2021

The following table summarizes our results of operations for the three monthended March 31, 2022 and March 31, 2021, respectively.

Three Months Ended March 31, 20222021 $ Change % ChangeRevenue$21,150,892 $5,461,539 $15,689,353287 %Cost of revenue3,165,4692,946,981 218.4887 %Gross profit17,985,4232,514,55815,470,865615 %Operating expenses:Personnel costs 25,975,8631,095,79324,880,0702,271 %Professional fees3,055,0392,415,198 445,146 26 %General and administrative 3,399,8961,388,574 2,011,322145 %Depreciation and amortization1,373,925367,259

1,006,666274 %Total operating expenses33,804,7235,266,82428,716,747542 %Loss from operations $ (15,819,300 ) $ (2,752,266 ) (12,872,339 )475 %Other expensesInterest expense(953 )2,472,048(2,473,001 ) (100 )%Other (income) expense(2,436 )231,720(234,156 ) (100 )%

Total other (income) expenses, net(3,389 )2,703,768

(2,707,157 ) (100 )%

Net loss before income tax $ (15,815,911 ) $ (5,456,034 ) $ (10,165,182 ) (290 )%Income tax expense (benefit) --Net loss (15,815,911 ) (5,456,034 )Other comprehensive lossForeign currency translation adjustment,net (1,064 )-Comprehensive loss (15,816,975 ) (5,456,034 )Net income attributable tononcontrolling interest129,222-Net loss attributable to Lottery.comInc. (15,687,753 ) (5,456,034 )Net loss per common shareBasic and diluted$ (0.33 ) $(0.35 )Weighted average common sharesoutstandingBasic and diluted 46,832,919 15,740,414 9Revenues.Revenue. Revenue for the three months ended March 31, 2022 was $21.2 million, anincrease of $15.7 million, or 287%, compared to revenue of $5.5 million for thethree months ended March 31, 2021. The increase in revenue was driven by thesale of $18 million in LotteryLink Credits for prepaid promotional rewards,marketing materials and development services.Cost of Revenue. Cost of revenue for the three months ended March 31, 2022 was$3.2 million, an increase of $0.2 million, or 7%, compared to cost of revenue of$2.9 million for the three months ended March 31, 2021. The increase in the costof revenue was driven by a larger percentage of internal development costsattributable to customer sales during the current quarter, partially offset bythe expiration of a high percentage of the pre-paid promotional rewardsunderlying the LotteryLink Credits that were issued to a Master Affiliate in thefirst quarter as a result of the delayed launch of such affiliate's promotionalprogram. The Company did not incur costs associated with redemption of most ofsuch LotteryLink credits.Gross Profit. Gross profit for the three months ended March 31, 2022 was $18million compared to $2.5 million for the three months ended March 31, 2021, anincrease of $15.4 million, or 615%. This increase was primarily due to the saleof $18.0 million of LotteryLink Credits for prepaid promotional rewards,marketing materials and development services, which generated significant grossprofit.Operating Costs and Expenses. Three Months Ended March 31,20222021 $ Change% ChangeOperating expensesPersonnel costs $ 25,975,863 $ 1,095,793 $ 24,880,0702,271 %Professional fees3,055,039 2,415,198445,146 26 %Sales & marketing907,686 1,244,906 (337,220 )(27 )%General and Administrative 2,492,210 143,6682,348,5421,635 %Depreciation and amortization1,373,925 367,2591,006,666274 %Total operating expenses$ 33,804,723 $ 5,266,824 $ 28,343,204542 % 10Operating expenses for the three months ended March 31, 2022 were $33.8 million,an increase of $28.5 million, or 542%, compared to $5.3 million for the threemonths ended March 31, 2021. The increase was primarily driven by increasedpersonnel expenses incurred from $22.2 million of stock compensation expense andincreased general and administrative expenses from public company expenses,increased headcount to support the Company's growth, increased marketing spendsresulting from the use of Gatehouse Media credits, which we received severalyears ago in exchange for warrants, and increased amortization expenses drivenby acquisitions made during the 2021 fiscal yearPersonnel Costs. Personnel costs increased by $24.9 million, from $1.1 millionfor the three months ended March 31, 2021, to $26 million for the three monthsended March 31, 2022. The increase was due primarily to an increase of $22.2million in stock compensation expense as a result of equity grants that werevalued at the share price soon after the Business Combination.Professional Fees. Professional fees increased by $0.6 million, or 26%, from$2.4 million for the three months ended March 31, 2021 to $3.1 million for thethree months ended March 31, 2022. The increase was driven primarily by publiccompany legal and professional fees including non-cash warrant issuances of

anapproximate $195,000.Sales and Marketing. Sales and marketing expenses for the three months endedMarch 31, 2022 were approximately $908 thousand, compared to $1.3 million forthe three months ended March 31, 2021, a decrease of $337,000, or 27%. Thisdecrease was due primarily to a decrease in media credits used during thecurrent period.General and Administrative. General and administrative expenses increased $2.3million, or 1,635%, from $.1 million for the three months ended March 31, 2021to $2.5 million for the three months ended March 31, 2022. These costs increasedin general with the growth of the business and can be broken down further into:increased travel of $0.4 million for business development opportunities,increased business licensing, bank fees, and insurance of $0.9 million, and $0.8million of additional office and software-related costs to support the increasedheadcount.

Depreciation and Amortization. Depreciation and amortization increased $1.0million, or 274%, from $0.4 million for the three months ended March 31, 2021 to$1.4 million for the three months ended March 31, 2022. The increase was drivenby the acquisition of the sports.com domain name in 2021 as well as theintangibles created through the purchase of Global Gaming.

Other (Income) Expense, Net.

Three Months Ended March 31, 2022 2021 $ Change % ChangeOther expensesInterest expense (953) 2,472,048 (2,473,001)(100) %Other (income) expense (2,436) 234,720 (234,156)(100) %Total other (income) expense, net$ (3,389) $ 2,703,768

(2,707,157)(100) %Interest Expense. We had minimal interest expenses for the three months endedMarch 31, 2022, compared to interest expense of $2.5 million for the threemonths ended March 31, 2021. This change was driven by lower debt levels as aresult of debt that converted into equity at the time of the BusinessCombination or settled in cash following the Closing. 11

Other Expense. We had no other expense for the three months ended March 31, 2022as compared to interest expense of $0.2 million for the three months ended

March31, 2021.

Liquidity and Capital Resources

Our primary need for liquidity is to fund working capital requirements of ourbusiness, growth, capital expenditures and for general corporate purposes. Ourprimary source of liquidity has historically been funds generated by financingactivities. For 2022, we expect to fund our operations, undertake anticipatedgrowth activities and make planned capital expenditures utilizing primarily theproceeds from the Business Combination and cash flows from operating activities,although our ability to do so depends on our future operating performance, whichis subject to prevailing economic conditions and financial, business and otherfactors, some of which are beyond our control.Upon the Closing on October 29, 2021, we received net proceeds of approximately$42.8 million in cash. As of March 31, 2022, we had $50.8 million of cash andcash equivalents and $88.8 million of working capital (current assets minuscurrent liabilities), compared with $62.6 million of cash and $88.3 million ofworking capital as of December 31, 2021.We expect that our cash on hand and cash provided by operations will allow us tomeet our capital requirements and operational needs for the next twelve months.As of March 31, 2022, there were no regulatory capital requirements applicableto our industry.We expect to deploy capital to fund our growth through implementing new productsand features within our B2C Platform services; marketing our B2C Platformoffering to new users; entering into additional agreements with new commercialpartners for our B2B API and LotteryLink credits; executing on strategicacquisitions and other synergistic opportunities; investing in and developingnew technology; and enhancing our existing technology in each of our businesslines, including distributed ledger technology.Execution of our growth plans, including further expansion of our business tonew U.S. states and international jurisdictions, may require additional capital,which we may seek through the issuance of equity or debt securities. If we arenot able to secure the necessary capital, or if the terms of financing are lessdesirable than we expect, we could be forced to decrease our level of investmentin new product launches and related marketing initiatives or to scale back ourexisting operations, each of which could have an adverse impact on our business,results of operations and financial prospects.Convertible Debt Obligations

Prior to the Closing, we funded our operations through the issuance ofconvertible promissory notes.

From August to October 2017, the Company entered into seven ConvertiblePromissory Note Agreements with unaffiliated investors for an aggregate amountof $821,500. The notes bore interest at 10% per year, were unsecured, and weredue and payable on June 30, 2019. The Company and the noteholders executedamendments in February 2021 to extend the maturity date to December 21, 2021. Asof both March 31, 2022 and December 31, 2021, the balance of these notes was$771,500.

From November 2019 through October 28, 2021, we issued approximately $48.2million in aggregate principal amount of Series B convertible promissory notes.The notes bear interest at 8% per year, were unsecured, and were due and payableon dates ranging from December 2020 to December 2022. For those promissory notesthat would have matured on or before December 31, 2020, the parties extended thematurity date to December 21, 2021 through amendments executed in February 2021.The amendments also allowed for automatic conversion to equity as a result ofthe Business Combination. Nearly all of the aforementioned promissory notesautomatically converted into shares of Common Stock or were terminated pursuantto their terms, as applicable, in connection with the Closing. Those that remainoutstanding do not have conversion terms that were triggered by the Closing. 12Immediately prior to the Closing, approximately $60.0 million of convertibledebt was converted into equity of AutoLotto. As of March 31, 2022, we had noconvertible debt outstanding.Cash FlowsNet cash provided by operating activities was $3.9 million for the three monthsended March 31, 2022, compared to net cash provided by operating activities of$3.9 million for the three months ended March 31, 2021. Factors affectingchanges in operating cash flows were increased revenue from operations whichwere offset by increased expenses for professional fees, personnel costs, andsales and marketing activities in 2022 as compared to 2021. Net cash used ininvesting activities during the year ended March 31, 2022 were $1.1 million,compared to $3.1 million for the prior year. The decrease was primarily theresult of a decrease in spending on capitalized software development. Net cashused by financing activities was $6.8 million for the three months ended March31, 2022, compared to net cash provided of $14.5 million for the three monthsended March 31, 2021. The decrease was primarily due convertible debt beingissued in 2021 which did not repeat in 2022 as well as the purchase of $6.5million of debt in 2022.

Emerging Growth Company Accounting Election

Section 102(b)(1) of the JOBS Act exempts emerging growth companies from beingrequired to comply with new or revised financial accounting standards untilprivate companies are required to comply with the new or revised financialaccounting standards. The JOBS Act provides that a company can choose not totake advantage of the extended transition period and comply with therequirements that apply to non-emerging growth companies, and any such electionto not take advantage of the extended transition period is irrevocable. We arean "emerging growth company" as defined in Section 2(a) of the Securities Act of1933, as amended, and have elected to take advantage of the benefits of thisextended transition period. We expect to remain an emerging growth companythrough the end of the 2023 fiscal year and we expect to continue to takeadvantage of the benefits of the extended transition period. This may make itdifficult or impossible to compare the financial results with the financialresults of another public company that is either not an emerging growth companyor is an emerging growth company that has chosen not to take advantage of theextended transition period exemptions for emerging growth companies because ofthe potential differences in accounting standards used.

Recent Accounting Pronouncements

In February 2016, the FASB issued ASU 2016-02, "Leases (Topic 842)." Thisguidance requires recognition of most lease liabilities on the balance sheet togive investors, lenders, and other financial statement users a morecomprehensive view of a company's long-term financial obligations, as well asthe assets it owns versus leases. ASU 2016-02 will be effective for fiscal yearsbeginning after December 15, 2021, and for interim periods within annual periodsafter December 15, 2022. In July 2018, the FASB issued ASU 2018-11 makingtransition requirements less burdensome. The standard provides an option toapply the transition provisions of the new standard at its adoption date insteadof at the earliest comparative period presented in the Company's financialstatements. We are currently evaluating the impact that this guidance will haveon our financial statements as well as the expected adoption method. We do notbelieve the adoption of this standard will have a material impact on ourfinancial statements.In June 2016, the FASB issued ASU 2016-13, "Financial Instruments - CreditLosses: Measurement of Credit Losses on Financial Instruments", as additionalguidance on the measurement of credit losses on financial instruments. The newguidance requires the measurement of all expected credit losses for financialassets held at the reporting date based on historical experience, currentconditions and reasonable supportable forecasts. In addition, the guidanceamends the accounting for credit losses on available-for-sale debt securitiesand purchased financial assets with credit deterioration. The new guidance iseffective for all public companies for interim and annual periods beginningafter December 15, 2019, with early adoption permitted for interim and annualperiods beginning after December 15, 2018. In October 2019, the FASB approved aproposal which grants smaller reporting companies additional time to implementFASB standards on current expected credit losses (CECL) to January 2023. As asmaller reporting company, we will defer adoption of ASU No. 2016-13 untilJanuary 2023. We are currently evaluating the impact this guidance will have onour condensed consolidated financial statements. 13

© Edgar Online, source Glimpses