This story was originally published on Climate & Capital Media.

One day late last year, Jim Robo stopped by the New York offices of Wolfe Research to brief the firm and its clients on NextEra Energy’s financial health and strategy in the world of sustainable power. Robo sat at a conference table across from his host, Steve Fleishman, one of Wall Street’s premier energy industry analysts. They were in shirtsleeves, not ties, a plastic water bottle for each — and as per COVID, the rest of the audience attended by Zoom.

Why do we care? Because after about an hour of presentation, questions and discussion, the most revealing statement was still Robo’s opening. "We have a long-term vision to be the largest, cleanest, most profitable clean energy provider in the world … to really lead the decarbonization of the entire U.S. economy."

That’s a mighty claim, even for the company that a year ago captured global headlines after briefly overshadowing ExxonMobil in 2020 as the stock market’s most valuable energy company. Although NextEra only wore the market cap crown for a day, its debut still stands as a harbinger of an energy future that has no time or money for fossil fuels. In a new, better, cleaner energy world, the only power sources with value will be decarbonized and sustainable — some shade of, if not completely, green.

One year and a new U.S. president later, that should seem self-evident. In the last 18 months, the vast majority of the global business community has thrown itself behind climate action. Even as the Biden administration battles for the votes to pass its ambitious climate agenda, there is little doubt that whatever form it takes, the plan will offer a historic lift to the burgeoning sustainable energy sector.

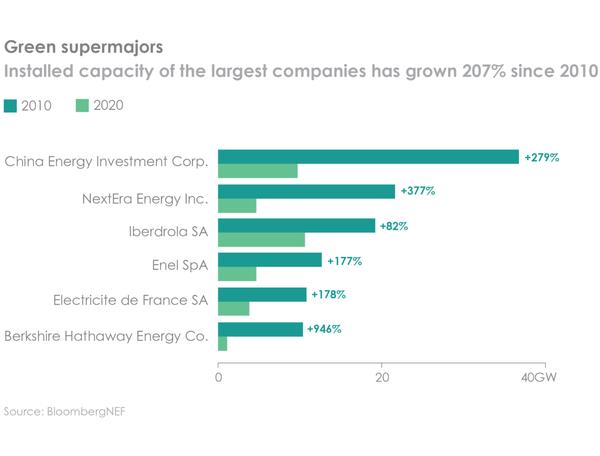

So if you let NextEra (NYSE: NEE) slip off the radar, think again. No other company outside of China produces as much power through solar and wind — and this one still only operates in North America. That would be 45.5 gigawatts. While thousands of green startup companies are out there, all chasing the same objective, none began a century ago as a coal-fired utility.

What distinguishes NextEra — and will likely propel it to the top of the heap for years to come — is that the folks who ran this Florida utility in the 1990s saw the threat of climate change early, as well as the business opportunity.

From humble beginnings to the ghost of Jack Welch

In 1925, then-Florida Power & Light (FPL) was a traditional fossil fuel-powered utility with a scattering of other offerings around the Sunshine State, including laundry services and — ice cream. It was a golden age, the occasion of the first big Florida land boom, a rush that against all odds has continued almost unabated to this day. Florida’s stunning growth guaranteed an ever-expanding customer base for its reigning utility. FPL built on that, Wall Street listened, and the company’s steady dividend stream made it a staple in many Americans’ investment portfolios.

With that momentum, FPL moved beyond Florida’s swamps into the business of supplying power elsewhere and by other means. They were the second U.S. company to build a nuclear power plant (they now have seven around the country). And during the 1990s, the management team in Juno Beach began pushing for cleaner (and safer) alternatives to coal. In 1998 the company launched its first wind power venture, near Helix, Oregon. By 2009, just a little over a decade later, Florida Power & Light had become the biggest provider of wind and solar power in the nation.

The same year saw a full-scale corporate reinvention. The company was renamed NextEra Energy, with a satellite, NextEra Energy Resources. In 2014, NextEra launched NextEra Partners, clean energy research and investment platform, and that year’s most successful IPO. And FPL? Amidst all that disruption, the old utility kept the lights on in Florida, nearly eliminated the use of coal and oil (from more than 20 percent of its capacity in 2005) and supplied NEE with the bulk of its net profits — 90 percent in 2020 and nearly 70 percent in 2019.

Channeling the spirit of 'Neutron Jack'

By all accounts, the man behind FPL’s renaissance as NextEra is Jim Robo. (That would be James L. Robo, but he’d prefer you call him Jim.) Robo rarely speaks to the press and did not grant Climate & Capital an interview.

He arrived at the company in March 2002 as a 39-year-old top management refugee from Jack Welch’s General Electric. (An exodus of senior management talent had preceded Welch’s 2001 retirement.) A summa cum laude graduate of Harvard and a Baker Scholar at Harvard Business School, Robo had been through a wide range of jobs at GE, from management development to CEO of GE Mexico and later, a top acquisition troubleshooter at GE Capital.

At the time, FPL was in the throes of its biggest management transition in decades. Its chief executive of 20 years had just retired. His successor had been a management consultant, at the time known for a series of successful acquisitions as a top executive for a food services company. Whether by luck or the board’s acumen, Robo was pulled into FPL just when they needed an ambitious, fearless, politically savvy personality who would assess the company’s strength from within and plant the seeds for change.

By the time he was appointed CEO in 2016, Robo had done just that. A NextEra filing with the U.S. Securities and Exchange Commission from that year documented 864 subsidiaries operating in the U.S. plus 187 operating outside the country. Impressive by any standard.

Robo’s strategy is eerily reminiscent of his old boss, "Neutron Jack" Welch — hard-charging acquisition of properties, leveraging federal and local tax credits and, as one analyst put it, "subsidy mining." NextEra was the second-biggest recipient of U.S. federal grants and allocated tax credits between 2000 and 2015, landing nearly $2 billion, most of it through a provision of the 2009 American Recovery and Reinvestment Act for renewable energy companies. The only company that received more was Spanish renewable giant Iberdrola (stay tuned for more on that little-known energy success story).

NextEra has cajoled and even bullied acquisition targets to build its empire. In 2016-17, the Fortune 500 company sued five tiny Midwestern townships to compel the municipalities to allow it to install wind turbines — prompting already vocal opponents in these communities to dub the company "Big Wind" in comparison to oil majors.

Few companies are as well known for their full-court press to lobby local, regional and federal governments to accede to their wishes. Spending about $4 million each year for lobbying efforts at the federal level, NextEra is among the busiest utilities advocating for its interests on Capitol Hill, most recently pressing for President Joe Biden’s ambitious Build Back Better legislation, and an array of other initiatives to bolster green hydrogen, electrical grid efficiency efforts and tax incentives for energy storage.

That’s on top of an estimated $1 million a year lobbying Tallahassee lawmakers and regulators to maintain its dominant position in Florida’s energy market, and lobbying and campaign contributions across 30 other states. (NextEra takes credit for its contribution to build a constructive market for renewable energy in the U.S.)

Tax credits helped NextEra (via NEER) to build a $61 billion portfolio of projects across 38 states and Canada, from wind turbines in Yarmouth, Nova Scotia to the solar panels that power the University of California, Irvine.

NextEra is relentless, but not always successful in its acquisition efforts. After several years of heavy spending on lobbying in South Carolina as it pressed to buy the troubled utility Santee Cooper, NextEra finally withdrew its offer in April.

The messy business of being 'green'

NextEra boasts that it is a green energy leader and the world’s largest generator of wind energy — all true — but its assets are not all green. If NextEra is to be the model of a sustainable energy giant, it must shed its brown assets.

Nowhere in its 2021 ESG report does NextEra even mention methane emissions — which are even more potent at trapping atmospheric heat than CO2 — buying into the narrative pushed by oil majors that natural gas is clean, or at worst, a viable transition fuel on the path to a sustainable economy.

Since morphing into NextEra, FPL has indeed moved away from coal — and in June closed its last coal-fired plant — but says it will still rely on natural gas for an astounding 60 percent of its power generation through 2029.

Meanwhile, NextEra owns seven operational oil and natural gas pipelines and is 30 percent owner of a 300-mile long pipeline being developed to carry fracked natural gas through the Appalachian Mountains despite long-running environmental opposition to the project, which has been cited some 300 times for erosion and sediment control violations. It is expected to be completed in 2022, about three years behind schedule and as much as $2.5 billion over budget.

NextEra also has seven nuclear power plants that are emissions-free, yes, but environmentally controversial.

Industry watchdogs such as The Energy and Policy Institute are looking for a firm commitment from NextEra on eliminating emissions in alignment with the Paris Agreement goal to keep global warming below 2 degrees Celsius.

"NextEra is the only large investor-owned utility that has not set any absolute carbon reduction goal," says Alissa Jean Schafer, an institute researcher.

But Robo is a man of action, with little patience for pronouncements. As far as he’s concerned, "Net Zero" is bull. "Right, go plant some trees and we get to net zero, or we’ll get to net zero as long as the technology works for carbon capture," Robo said during a virtual conference hosted by S&P Global Sustainable1 in May. "But the reality is that carbon capture technology doesn’t work and you’re not going to come up with a magic small reactor that will be cheap enough … So I think it’s very disingenuous for a lot of folks in our sector to come out with net zero commitments when they don’t have a view to get to what I call ‘real zero.'"

On earnings calls, Robo has instead focused on NextEra’s plans to slash "carbon intensity" which measures carbon emissions against total electricity produced. Again, no mention of methane emissions.

Where it is headed

While Robo keeps his head down and sleeves rolled up, the company is plotting its expansion into energy storage and green hydrogen, technologies at the leading edge of clean energy.

NextEra has plunged into the utility-scale battery business, with storage facilities in 11 U.S. states and Ontario, Canada with many more planned. These developments bolster the sustainable power grid — providing a way to retain all those green gigawatts of electricity and make them consistently available to customers regardless whether the wind blows or the sun shines. The company is testing scalability with a project in the middle of central Oregon that combines the trifecta — wind, solar and battery storage — to provide power to the city of Portland.

NextEra has earmarked a whopping $60 billion in capital spending for 2019-2022 for its planned green transformation across the company. By 2024, according to its 2021 ESG report, Next Era Resources will expand wind, solar and battery holdings by 23 to 30 GW, or by about 150 percent.

Providing a tailwind for NextEra is the plummeting cost of renewable energy, and lithium-ion batteries to store it.

"We’re finally at the point where renewables with tax credits are at cost parity with fossil fuel-derived power on a utility system," says Credit Suisse analyst Michael Weinstein.

With Biden in the White House, NextEra has an opening as never before. The tax credits for renewable energy investment that helped get NextEra where it is today were extended in June.

The company has been lobbying for many climate-related provisions in Biden’s proposed Build Back Better legislation, including new credits for transmission and storage, including green hydrogen, to accelerate decarbonization of the electric grid and build infrastructure for electric vehicles.

While lobbying for these changes, NextEra is preparing to exploit the opportunity. The company has a green hydrogen pilot project under development at its Okeechobee plant in Florida. Meanwhile, in January, NextEra announced a partnership with First Student and First Transit to convert 43,000 yellow school buses and 160,000 public transit buses and other vehicles to electric and hydrogen power.

Competition

NextEra already faces a world of stiff competition out there, from well-established U.S. outfits such as First Solar and Brookfield Renewables to little-known, even more powerful European entities such as Iberdrola, Enel and Avangrid.

And as the economy shifts toward sustainability, NextEra will face a rush of new entrants to the market, including oil majors making sure to have a foot in both worlds. These companies are moving into wind and solar even as they push for dubious technologies such as "blue hydrogen" and resist the growing movement against oil and gas development.

But there’s a lot of room for growth. Currently, the IEA says less than 20 percent of U.S. power comes from renewable sources, and about the same amount comes from nuclear power. The Biden administration has set a goal of entirely carbon-free power for the U.S. by 2035. That will require trillions in investment in the U.S. alone. A global energy transformation will require a $22.5 trillion investment in renewable capacity, according to the International Renewable Energy Agency (IRENA).

Robo has his focus on the bottom line: "The thing about the green economy is that it’s cleaner, it’s greener, but it’s also cheaper, and that is why it’s so powerful."