It was more than a decade ago that bitcoin was launched, introducing with it the digital ledger known as blockchain. The first cryptocurrency ever created, bitcoin is by far the most popular and most valued cryptocurrency to this day. But even with all the relentless buzz surrounding bitcoin, ethereum and other digital coins, cryptocurrencies and the revolutionary blockchain technology on which they're built remain a mystery to most.

Despite the evangelizing by crypto investors, including some celebrities, a 2021 poll by Pew Research Center found that just 16% of Americans said they have ever invested in cryptocurrencies. That broadened to 31% between the ages of 18 and 29 and to 43% of men in that age range, compared with 19% of women in that same age range.

For the many people outside of those percentages, it may be that a healthy skepticism of digital currencies has deterred them from attempting to understand the lingo or the technology.

But as cryptocurrencies and related technologies reach into politics, intertwine with the larger economy, impact the environment, and are increasingly targeted by scammers, it behooves most to have a general sense of what cryptocurrencies are, how they work and what their pitfalls and potential are. With that in mind, here is a basic overview of cryptocurrencies and blockchain technology for the uninitiated.

Is it "blockchain" or "the blockchain"

It's either, depending on usage. A blockchain is a type of database. Different cryptocurrencies are built on different blockchains. Bitcoin is built on the bitcoin blockchain and ether is built on the ethereum blockchain. Some cryptocurrencies or tokens are built on top of other cryptocurrency blockchains. For instance, many new tokens are built on the ethereum blockchain — but at the most basic level, all cryptocurrencies are supported by a blockchain.

When referring to the technology, call it "blockchain." When referring to the public ledger system as a whole, call it "the blockchain."

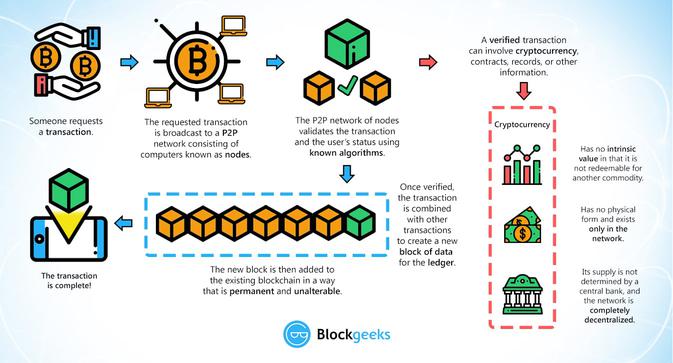

Blockchains record cryptocurrency transactions in encrypted, digital records that live on servers all around the world. Some blockchains allow developers to build in applications and program contracts. Blockchains can also be used to record other types of information — like property records or the origins of a food item.

NFTs, or nonfungible tokens, which are digital items — like an image or video — that are secured and stored on the blockchain to assure each item, or asset, is unique and unchangeable, are the latest buzz-generating trend to come out of blockchain technology.

Is there a simpler way to think about this?

Fundamentally, cryptocurrencies are digital money. The blockchain is a database, or digital ledger, for recording transactions of said digital money. This digital money isn't backed by any government or institution.

How are cryptocurrencies made?

Different cryptocurrencies have different digital architectures (code) so how they work varies. As an example, let's use bitcoin, which is "mined."

Here's how crypto mining works: networks of specialized computer processors running on vast amounts of electricity and producing an astonishing amount of noise and heat, compete to solve a mathematical puzzle — calculations required to verify the most recent bitcoin transactions, record them on the blockchain and ensure the blockchain is secure.The computer that solves the puzzle first wins newly minted bitcoin. This design is part of the open source code created by the anonymous entity, known as Satoshi Nakamoto, who launched bitcoin in 2009.

The mining system design encourages participants to spend resources (in this case money and electricity) to help maintain the record of who owns which bitcoins. Read more about it here.

Now what is all this about decentralization?

An additional feature of the blockchain's design is that a public record of transactions is held on many computers that together form a global network. These computers — or nodes — constantly check information against each other to confirm their records' accuracy. The replication of these records across the network is part of what prevents an incorrect or fake transaction from being logged.

Together, the decentralized and open source nature of the blockchain means that no one person or institution can control it, although governments and large corporations can limit access to digital tokens in certain circumstances. China, for instance, outlawed cryptocurrency trading in September 2021 because of concerns that cryptocurrencies could weaken the government's control over the financial system and were facilitating crime. More recently, a major cryptocurrency exchange, Binance, stopped processing purchases made with certain credit cards issued in Russia over its invasion of Ukraine.

How secure is blockchain?

Cryptocurrency buffs consider blockchain pretty hard to hack — that's part of its appeal. But how secure a blockchain is depends on which platform you're talking about.

The bitcoin blockchain has not been compromised to date, but the second largest blockchain and cryptocurrency, ethereum, faced a major crisis in 2016 stemming from a software vulnerability. While the ethereum blockchain itself was not hacked, some $50 million in ether was stolen.

Many cryptocurrency-related services and technologies have been hacked or simply exploited by their designers to deceive and steal from participants.

Cryptocurrency exchanges — where people can trade cryptocurrencies for traditional currencies — have been compromised multiple times, with digital bank robbers clearing out the accounts. Memorably, in 2018, the CEO of a cryptocurrency exchange died without relaying a crucial passcode, effectively locking customers out of millions of dollars' worth of cryptocurrencies.

Whether they're a victim of a scam or security breach or have simply forgotten their digital wallet's password, consumers have few recovery options. There is no password reset or insurance in the preprogrammed, decentralized system.

In short, the investments are backed by few protections. U.S. prosecutors do pursue outright criminal behavior, like false advertising or stealing, but if the value of a new cryptocurrency token plummets and does not recover, that money is lost. Even the value of bitcoin, which some proponents call "digital gold," is extremely volatile.

A final thought: Cryptocurrencies remain criminals' payment of choice. Illegal drugs or other barred commodities are often exchanged for cryptocurrency, which can be transferred across distances more easily than cash and can be harder for prosecutors to trace. But for most cryptocurrencies, the record of who owns what is publicly visible, forcing criminals to become savvier in order to effectively launder cryptocurrencies obtained through theft, scams or ransomware attacks.

Where does the "value" of cryptocurrencies come from?

This age-old question — who decides what a buck is worth? — is further complicated with cryptocurrencies. Unlike traditional currencies, no government, central bank or physical asset backs cryptocurrencies.

Instead, their values are based on people's faith in them, as determined by the market. Backers hope that more and more people will want a digital currency that is relatively free from government oversight — and that, as people sink resources into cryptocurrencies, their value will increase over time.

Also unlike traditional currencies, some cryptocurrencies function both as an investment and a potential unit of exchange. Some consumers buy bitcoin hoping they can eventually sell it for a profit. Others might use a fraction of a bitcoin to get a firecracker pork burrito at New Hampshire's Taco Beyondo — one of a growing list of businesses that accepts bitcoin as payment.

What about environmental impacts?

As mentioned, crypto mining consumes a great deal of energy. One peer-reviewed study calculated that, as of November 2018, bitcoin's annual electricity consumption was 45.8 terawatt hours, comparable to Hong Kong's net electricity consumption in 2019, according to the U.S. Energy Information Administration. That doesn't even take into account energy consumed by other cryptocurrencies.

Also, bitcoin's energy consumption has increased annually: The Bitcoin Mining Council estimated the cryptocurrency consumed 220 terawatt hours of energy in 2021.

When judging the environmental impacts of cryptocurrencies, it's important to consider the electricity's source. Crypto miners typically want electricity at the lowest cost, which oftentimes leads them to high-polluting energy sources like coal. Other times, logistical restrictions lead them to seek out the cheapest energy available from renewable sources like hydroelectric dams. Those variables must be considered when calculating cryptocurrencies' exact energy consumption and environmental impact.

Environmental impact also includes energy used to cool computer processors, which heat up as they work, as well as the electronic waste produced as miners upgrade their equipment and discard older models or broken units.