Financial strategist at eBooleant Consulting LLC & Micro Macro Infinity, which provides his insights into economics, markets, and investing.

What happened to the roaring 2020s that so many predicted just a year ago? The press openly spoke about it with vivid expectations. Now, there is less perkiness and few mentions of a potential roaring ’20s of the 21st century. It all seems to have changed fast, leaving investors unsure about what is next.

The rate of change is accelerating. Americans are accustomed to a lot of change, particularly in technology. Now they must deal with a rate of change bumped even higher by a global reassignment of relationships in war and Covid-19.

Risk, by definition, means you cannot predict any specific outcome. And risks of all sorts are high. Still, there are strategies that will help make better investors now. Expect technical advances to surpass the microchip and computer. It is hard for an investor to see future tech if they are too enamored with today’s tech stocks. Investors, like cryptocurrency hoarders, may believe too much in their current investments to notice when they become passe. And of course, risks can lead to a lot of volatility. Investors may need to insure against an adverse outcome. Here are some tips for investing in this time.

1. Do Not Be In Love With Your Investments

Corporations, even dominant ones, do not last forever. Neither do high-flying startups. Veteran investors learn this by experiencing the demise of some of their favorite firms. Seasoned investors were once new investors, who saw their favorites hit tough times. One example was General Electric. Investors saw it as nearly invincible and the stalwart of many retirement portfolios. Its demise is a classic of the digital age. General Electric was at one point the world’s most valuable company, but the company split into thirds in 2021. Its descent from its peak was spectacular, and it was also the end of the conglomerate model for many companies. It was a huge hit to true believers in the firm.

MORE FROMFORBES ADVISORBest Travel Insurance Companies

ByAmy DaniseEditorBest Covid-19 Travel Insurance Plans

ByAmy DaniseEditorThe demise of older tech companies has lessons for today. Let us look at cryptocurrency. One estimate postulates that cryptocurrency has about 27 million investors just in North America with many true believers. Now the banks have jumped in. The market is an institutional market with 99% of its Q4 2021 trading by institutions. The trading is highly opaque and subject to uncertain regulation. One can like a market like that but not love it. Investors need to hold crypto within highly diversified positions, like any other asset.

2. See Opportunities At The Edge Of Science

The U.S. is facing a broad international challenge. For investors, this is an extraordinary time of opportunity as innovative technologies emerge. The U.S. and China are entering what may well be the greatest scientific and military competition in history. The magnitude of the competition is only going to increase as China continues to ramp up its scientific efforts against the U.S. China’s efforts started in the 1980s. The nature of the efforts includes the most advanced level of technology currently known, the Torch Program.

The Chinese initiated the Torch Program in 1988 with ambitious goals: “The program mainly involves projects in new technology fields, such as new materials, biotechnology, electronic information, integrated mechanical-electrical technology, and advanced and energy-saving technology.”

The last scientific/military race of this magnitude occurred with the Manhattan Project during WWII. This race was to apply the concepts of quantum mechanics to make a bomb. That science was only a few decades old. But scientists had never applied it in this military way. In the end, the Manhattan Project employed the greatest physicists of America and Europe to outrun Nazi Germany in making an atomic bomb.

The current race in artificial intelligence, hypersonic weapons, quantum telecommunications and many other fronts is in full stride. A recent Harvard study believes that China is now either in the lead or will soon lead. It is early, and the likelihood is that the competition will lead to discoveries of unimagined importance.

The potential for investors is vast but uncertain. For example, we do not know which, if any, of the quantum computing companies will hit the right configuration to be the leap to a new level of machine intelligence, but the wealth potential is beyond anything GE ever could offer.

3. Add Insurance If You Need It

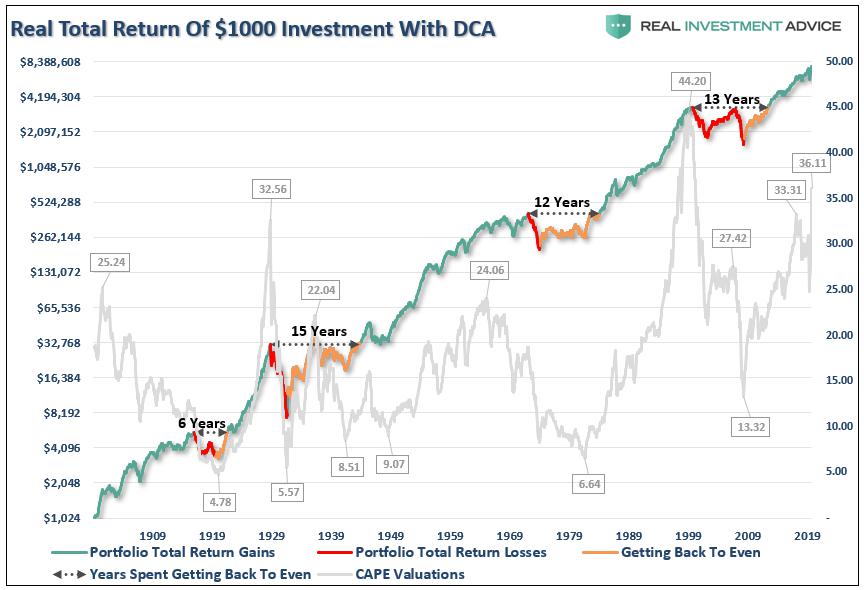

Risk management lies at the heart of any successful investment program. But risk management is even more difficult in a wartime scenario. A key problem is that most risk management strategies rely on the creation of portfolios of assets with offsetting risk. That is when one stock goes down in price others move to offset it. Technically, this means that the stocks are less than perfectly positively correlated.

The construction of this type of portfolio relies on knowing how we should expect one asset price to move relative to others. The general way to identify these relationships is to use a long history of prior price movements. These correlations, however, have the unfortunate habit of changing in a crisis. Just when you need to know how the security prices would react to one another, the correlations change.

Larger cash allocations or insurance may be necessary for an extremely volatile period. Single low-risk bonds with maturities matching expected future cash needs may be the best strategy. But investors should buy the insurance they need.

Optimism Over Pessimism

Investors should see this as an extraordinary period of disruption. Disruption, as we have come to know, is a risk-return proposition. We cannot see exactly what will happen in the markets. The good news, however, is that returns should dominate investor risk as we work our way to a more stable world order.

Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms. Do I qualify?